does colorado have inheritance tax

Info about Colorado probate courts Colorado estate taxes Colorado death tax. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in.

Colorado Last Will And Testament Legalzoom

A state inheritance tax was enacted in colorado in 1927.

. Not the size of the decedents entire estate as a whole. 4 the federal government does not impose an inheritance tax. Colorado Inheritance Tax and Gift.

The State of Florida does not have an inheritance tax or an estate tax. What is Inheritance Tax IHT and do I have to pay it. Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes.

When it comes to federal tax law. Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

No Colorado does not have an inheritance tax. Technically there is only one case where a Colorado resident would have to pay an inheritance tax. Yet some estates may have to pay a federal estate tax.

My children are worried they. There is no estate tax in Colorado. However Colorado residents still need to understand federal estate tax laws.

Unlike estate taxes inheritance tax applies to the size of the individual gift or inheritance. Inheritance tax rates vary based on a. That tax is levied after the money has passed on to the heirs of the recently deceased.

What documents or supporting evidence do you have. Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. There is no estate or inheritance tax collected by the state.

A state inheritance tax was enacted in Colorado in 1927. Robin D. Until 2005 a tax credit was allowed for federal estate.

Types of Estate Administration. Does Colorado have an inheritance tax. Spouses are automatically exempt from inheritance taxes.

The estate tax is different from the inheritance tax. What is the estate tax in Colorado. Does Colorado Have An Inheritance Tax.

Up to 15 cash back Does Colorado have a state inheritance tax. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. How much tax do you pay on inheritance.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance. As well as how to collect life insurance pay on death accounts and survivors. Yet some estates may have to pay a federal estate tax.

This really depends on the individual. It is one of 38 states with no estate tax. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. How does inheritance tax work for Colorado residents. It happens only if they inherit an.

There is also no Colorado inheritance.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Monday Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

What S The Difference Between Estate And Inheritance Taxes Hammond Law Group

Where Not To Die In 2022 The Greediest Death Tax States

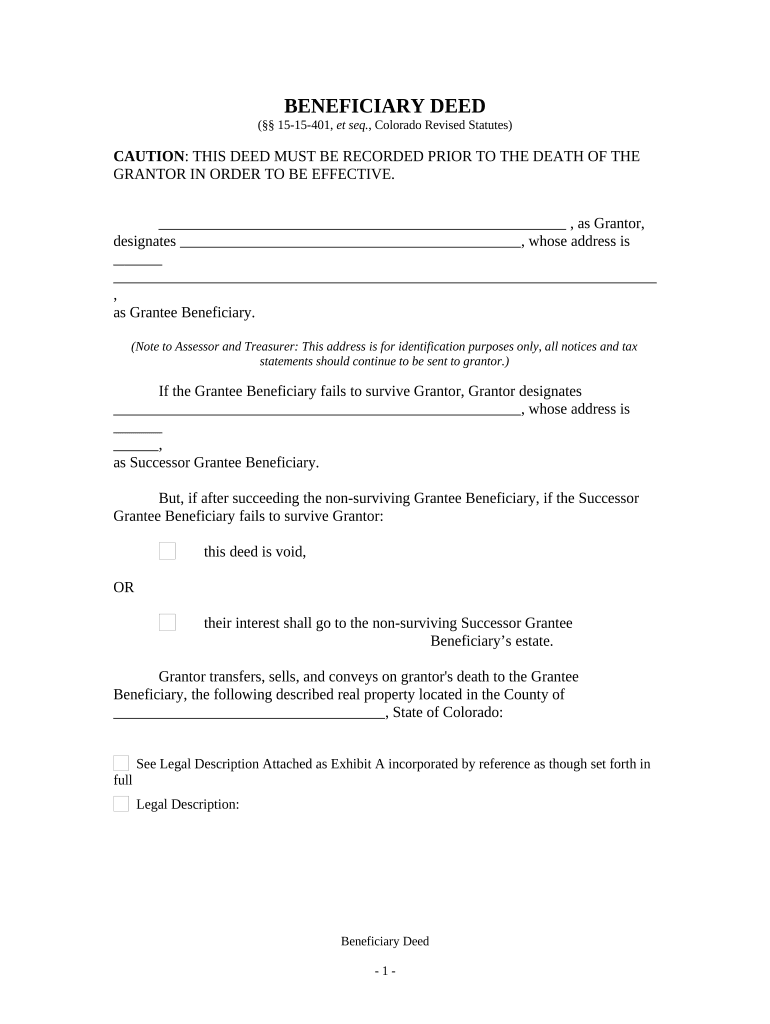

Colorado Beneficiary Deed Form Fill Out Sign Online Dochub

Colorado Eldercare Planning Council Members Estate Tax Trust Retirement Planning

Boulder County Colorado Lodged Wills Inheritance Tax Waivers 1899 1975 An Annotated Index Iron Gate Publishing

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

How Many People Pay The Estate Tax Tax Policy Center

Estate Tax In The United States Wikipedia

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Retirement Tax Friendliness Smartasset

What Taxes Do You Owe On An Inheritance Business Gazette Com

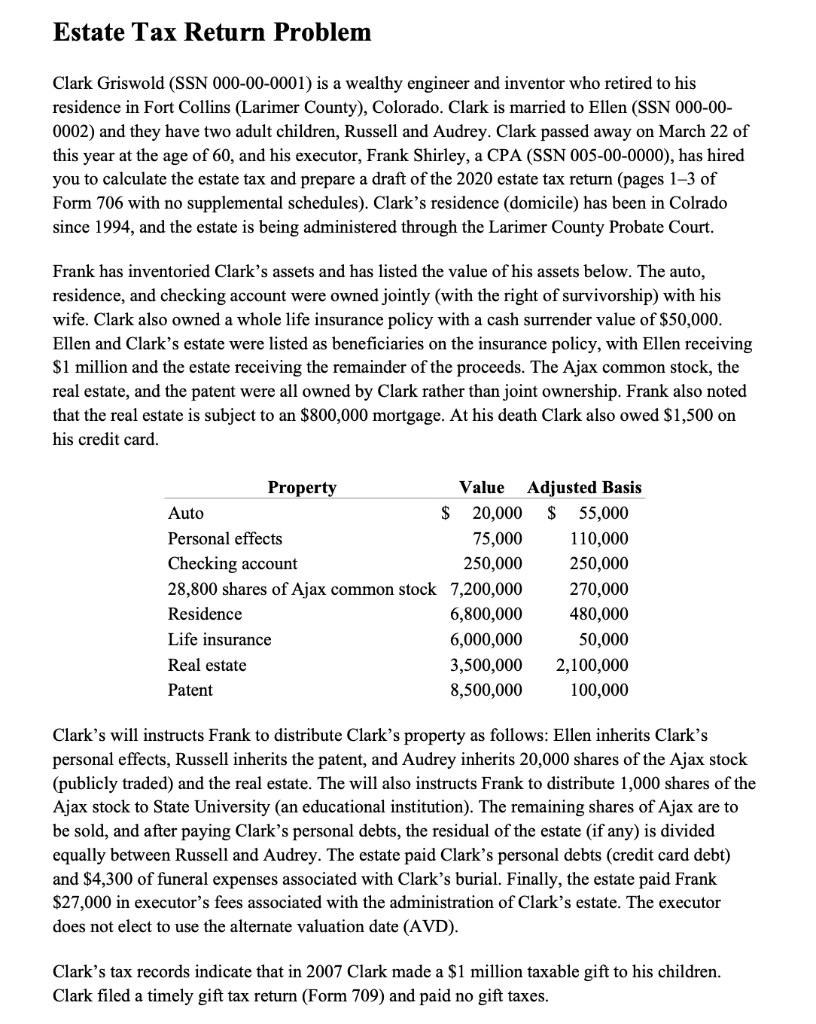

Solved Estate Tax Return Problem Clark Griswold Ssn Chegg Com

Do I Need To Worry About Estate Or Inheritance Taxes The Hughes Law Firm

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate